Here are all the reasons NOT to put your money in retirement accounts, and how to leverage them in unorthodox ways.

It's no secret 401k plans have fees. What's not commonly ? A low yearly fee can compound to be more expensive than a TAXABLE account.

It used to be the case that your employer sponsored plan with a 401k provider would get you access to cheaper funds with lower expense ratios. Thanks to ETFs like Vanguard, and incompetency of 401k providers like Fidelity and Empower and perhaps the lame plans that employers sign up for, expense ratios are more or less the same now. In my own case, they are more expensive (which is not very empowering).

Further, inside a 401k you have a LESS diversified portfolio, which equates to higher risk. My 401k provider only has 31 different funds to choose from, and many of them are just age bracketed retirement accounts. These are broad funds, but they are expensive, not diverse enough, and rob me of control over how I allocate my money. Investing across multiple asset classes, market sectors, company sizes, and countries is more expensive than a taxable account or impossible when going through my 401k.

401k Fee math

Parameters

401k plan fee of 0.89% AUM

Expense ratios 0.5% more expensive in 401k

Calculations

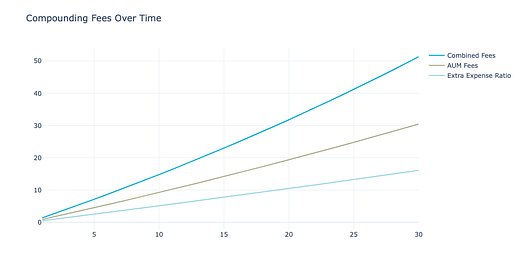

0.89% fee per year ^ 30 years = 30.45%.

0.55-0.8% expense ratios in 401k vs 0.005-0.5% in market. 0.5% ^ 30 years = 16.14%

(0.89% fee + 0.5% expense ratio diff) ^ 30 years = 51.3%

The takeaway is that fees can really eat into your gains, to the point that a lower fee taxable account might be preferable. Yet rather spectacularly, nobody has told me this.

But what about my taxes being lower in retirement?

A common pro-retirement account argument is that your taxes will be lower when you retire. That is, if you're using a traditional tax advantaged 401k/IRA instead of a roth and expect a lower income in retirement.

Example: If you're making $150k now but you only plan to withdraw $60k in retirement, then your effective tax will be 17.6% instead of 25.3% (2023 rates for federal plus FICA). That's a 7.7% benefit.

Now let's run the same example from above with a $100,000 investment with 30 years left before retirement

Parameters

Pre retirement tax rate of 25.3%

Post retirement tax rate of 17.6%

401k plan fee of 0.89% AUM

Expense ratios 0.5% more expensive in 401k

Calculations

Taxable: 100,000 - 25.3% -> 74,700 * 30 years of gains at 8% (10.06x) -> 751,680 -> 676,979 taxed in capital gains on withdrawal at 15% -> 575,432 post tax gains + 74,700 principal -> 650,132

Traditional: 100,000 -> [gains at 8% - 0.89% AUM fee - 0.5% more expensive expense ratios = 6.61%] (6.82x) -> 682,000 - 17.6% tax rate in retirement -> 561,968

Roth: 100,000 - 25.3% -> 74,700 * 30 years of [gains at 8% - 0.89% AUM fee - 0.5% more expensive expense ratios = 6.61%] (6.82x) -> 509,634

Hopefully it's pretty clear now that high fees can make all the difference.

Caveats

Tax rates now may not be the same in the future. My guess is they'll probably go up. At the same time, long term capital gains taxes will also probably go up. It’s always possible that they go down, but I’m not betting on the government asking for less money over the long term.

Your taxable funds could go into anything - real estate, crypto, a vacation home that you airbnb, a "business" that's actually just a hobby you figured out how to make money on, etc. Your 401k is restricted to a very small number of options, almost all stock/bond-related. Your IRA has more flexibility, but also still limited and not without complications.

IRA/401k Case Gets Worse

Let’s say you’re a big fan of how much better your post-retirement income tax rate would be. Say you make $300k a year now and want to live like a monk in retirement. Clearly traditional retirement accounts are the better option since you pay taxes when you retire, BUT you’re in for some nasty surprises.

First: IRAs have income limits. If you're single and make $73k or more, you won't benefit from a traditional IRA [irs.gov]. Instead you’re limited to only the roth IRA and have to do the backdoor roth method - this 6 minute video explains it pretty well. While you no longer can use a traditional IRA, it’s not really a big deal for a roth IRA, it just takes more steps to get the same amount of money into your account.

Second: Say you started contributing to your roth IRA since you still want to be in tax advantaged accounts. If you still want to contribute to traditional accounts you can still use your 401k. There’s a big catch: You have to leave those traditional 401k funds sheltered in the 401k unless you want to face a massive tax bill. If you try to go from traditional 401k —> traditional IRA, then any backdoor roth IRAs you want to do get subjected to a bunch of income tax proportional to your traditional IRA balance. This is called the pro-rata rule. To

Here’s a good video explainer on the pro-rata rule and why you essentially should never convert traditional 401k → traditional IRA if you plan on making backdoor roth contributions.

TLDR: Traditional makes sense over roth when your income is higher, but that is also precisely when it becomes the most difficult (if not impossible) to contribute to your traditional accounts. It’s far easier to only deal with roth if you want the flexibility/advantages of an IRA over a 401k.

IRA Gets Better, Taxable Gets Worse

Unlike a taxable account, you can rebalance whenever and as often as you want. If one sector of stocks over-perform in any year you can re-weight your portfolio at any time without incurring capital gains taxes.

On the taxable side, selling your over-performers to rebalance is a taxable event. You can minimize this by contributing more towards your under-performers until everything evens out. There’s also tax loss harvesting to look into.

401k Gets Better

Literally the only other "pro" I can think of is that you can't touch your money. Which is not really a pro unless you lack self control.

Early Retirement

If you want to retire early, it’s much easier to start taking withdrawals from your taxable balance first. Roth IRAs you can withdraw your contributions before retirement age penalty-free (after it “seasons” for 5 years), and for qualified hardship distributions. 401ks are not obligated to offer participants access to hardship distributions.

See this if you’re in IRA-land: Hardship distributions for IRAs

There’s also SEPP: you can get around the 10% penalty by agreeing to take equal payments from now until you hit your life expectancy. I don’t really like this though, since once you start your withdrawals you cannot stop them until you die or hit age 59.5 - you basically nuke your 401k/IRA. If you think this might be useful to you, here’s another [video explainer] by the same source as earlier.

Summary

Your tax-advantaged accounts could be more expensive than a taxable account. They might be cheaper. You can do the math from your phone and figure out what makes the most sense for your situation.